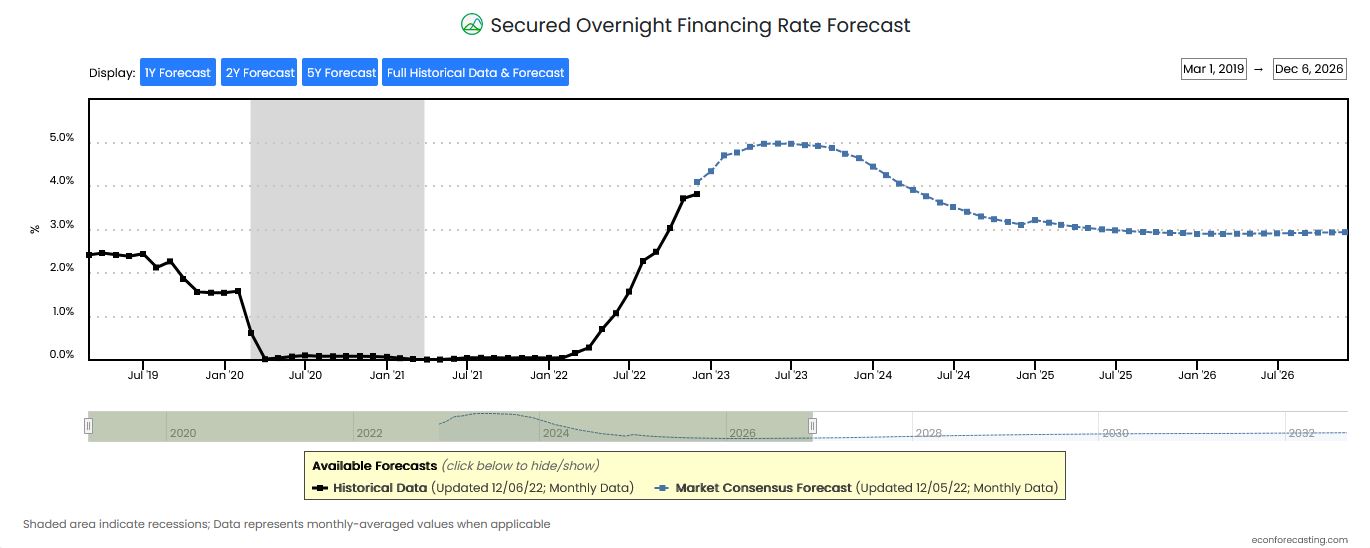

SOFR was near zero earlier this year and is around 3.04% and rising as of December 2022.

#SOFR (Secured Overnight Financing Rate) was created in 2019 as a replacement for the London InterBank Offered Rate (LIBOR) following the 2012 #LIBOR manipulation scandal.

Forecasts show the rate will hit 4.97% by July 2023 and inch its way back down to 3.00% by July 2025

24 months…

Quotes for

- Bridge loans have been in the SOFR+500-700bps range = 8.00-10.00% today.

- Construction loans have been in the SOFR+700-850bps range = 10.00-11.50% today.

There is plenty of capital to deploy.

Capacity and willingness by the borrower is another story.

It may take borrowers time to understand how to hedge their costs with gap products.

Those include private activity bonds and #CPACE.

Call us today if you need assistance assembling a capital stack that works.

I write seven days a week to help business owners and real estate investors:

✅ Accelerate value,

✅ Become better leaders,

If this was helpful:

👊 Please share this post with your network

👊 Follow me for more on strategic planning and finance

https://www.dropbox.com/s/2jd8y7b0scssplj/SOFR%20Rate%20History%20and%20Forecast%202026.pdf?dl=0